Been a few years, I’m happy to say I’m going to be active on this blog again. What follows is a stream of conscious on various topics and updates since I last posted. I’ve tried to break out the topics into various headings so you can skip around

Buying a House During a Pandemic

2020 was a great year for me. I hope COVID didn’t hurt anyone too bad, it truly sucks but hopefully we are on the up and up now.

I started off the year with strong client base and hourly work. The plan was to buy a house and being self-employed lenders are more strict.

The most common rule is to take the average of your last 2 years income and that’s what lenders use to qualify you for mortgages. They don’t take kindly to taking obscene deductions as that lowers your taxable income so you do have to do a bit of prep to buy a house.

I buckled down and made as much as I could in 2019 and then kept the train rolling in 2020. Buying a house during a pandemic in a new city was nerve wrecking but well worth it. My wife helped me see the benefits of not focusing too much on the housing market but more that we could afford the house and knew it would be good.

Being a data nerd I also looked FRED and the consensus 2020 would be bad for houses seemed off-base. As a bettor or someone who likes to take chance this was a great opportunity. The most recent recession severely affected real estate so that correlation was fixed in peoples minds. Recency bias was making people over estimate the downward impact in housing. Housing lending standards have greatly improved since then. Home equity % was higher than in the past and remote work will really help suburbs and places without a strong local job market. Las Vegas is/was a perfect choice for that. When I bought there was a lot of consensus thought that we were in the end of times. Markets consistently over-react and I’m very happy we made the decision to move to Vegas. Time will tell if there is another major crash in values however I don’t think it will be nearly as bad as 08.

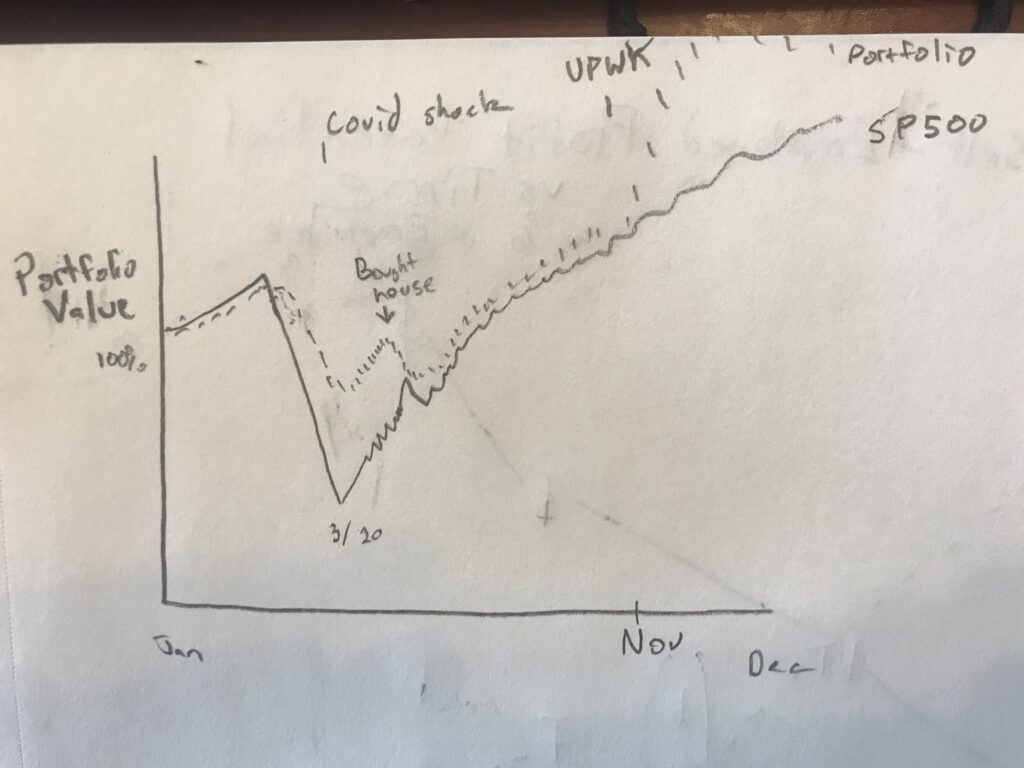

As our contingencies to back out disappeared the stock market was crashing. ~30% in 2 months!

Thankfully I didn’t get greedy when we decided to buy a house a year before. I missed out on some market gains but took the downpayment and stashed it away in a high yield savings account. Risk of ruin is one of the most important risks to avoid.

I write this 1 year after closing on this house.

Freelancing During a Recession

So we just bought the house but we weren’t going to move in until August. It was a little nerve racking to do a rent-back agreement with the sellers but we had a good contract and security deposit so I felt OK.

Regardless buying a house is scary. It could burn down, we could have bought a leaky lemon of a house, and we still needed to move and furnish it. We’ve only gotten ~1 inch of rain if not less in the last year so to be honest I have no idea if it leaks. Anyways.

I kept the momentum I did from getting my average income up and steamed ahead earning as much as I could. The best times to make money are to have it during recessions.

Over the years I’ve tried to keep a diversified book of business. Different industries generally. I was thankful none of my clients had any issues during the recessions so all I had to do was keep them happy and continue billing.

I worked 6-7 days a week at this time. Often staying up until 1AM if not longer working. It wasn’t necessarily 14 hours days but I had a lot of work. COVID made it easy to do work as we were all pretty much quarantined for months.

I kept my head down and I socked away as much money as I could and invested it continually during the crash. I can’t say I expected to stimulus to be this huge but long term the S&P 500 is a pretty safe bet. Now I sit in a good position where I can start to focus on doing more of what I want. I still need to earn a living and am in no way retired.

Execution is tough. While I was on the right side of covid, it was rather obvious what would happen when Italy looked like it did and the reportably successful enforcement action in China was. Knowing to avoid the nasdaq 100 even though it was a cheaper put and not thinking more about the future of work was an error.

The 2nd 3rd order effects are hard to predict! Senator Kelly Loefler likely knew and invested in Citrix not Zoom…

Freelancer Income

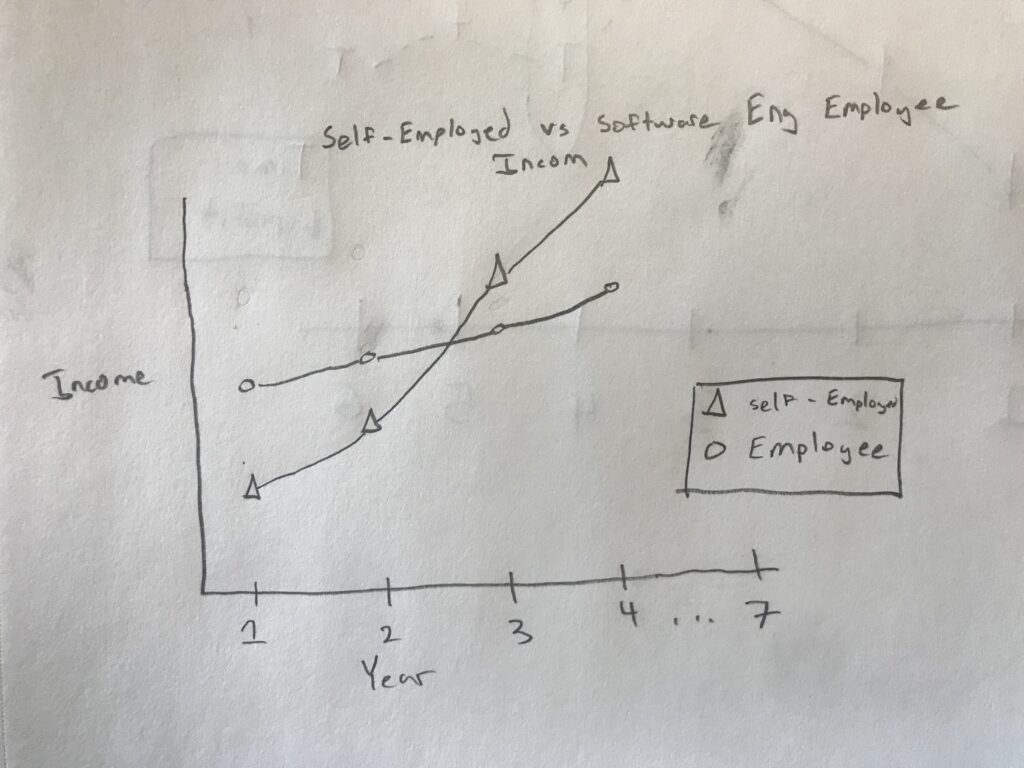

Is freelancing risky? Yes at first but once you get going you have more control over your income and are less affected by firings or “losing a client”

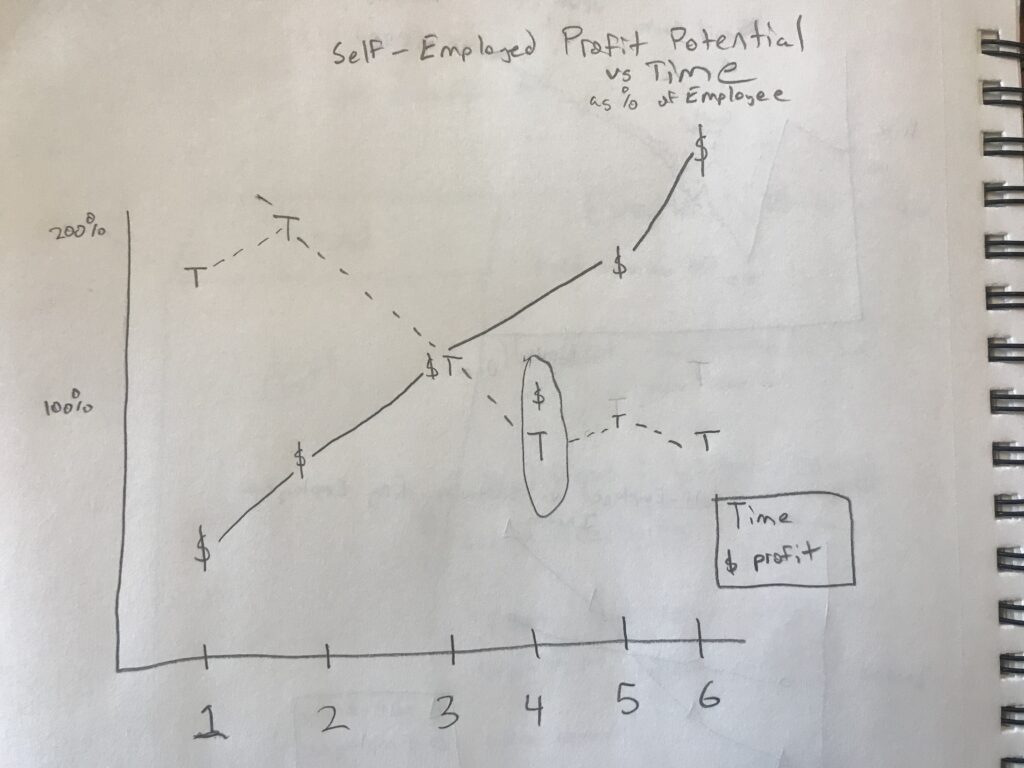

I often refer to the following charts as a rough idea of how my freelancing career should go.

The biggest issue with normal jobs is you don’t have as much upside potential. And you have to decide things like quitting your job to pursue an idea.

I don’t now. I just need to reduce my hours on client work and use the rest on my upside ideas. I’m still able to make money and stay in the job market but I won’t be making enough. Regardless if I don’t think my upside ideas are promising enough, I can always work on increasing my hours again.

This flexibility is hugely valuable. Optionality, the ability to choose each day what to do is amazing. I wish I had this free time last year so I could have studied COVID impacts and trading execution faster. I believe I could have bought better puts a week earlier had I not been in the process of buying a house and working like crazy for my clients. Ackman saw it and the data was all there.

As life goes, the ability to hang out with friends and family at a moments notice and not having recurring liabilities in the form of meetings is important.

Being Who I Want Now

I’m striving to make my life more how I want it and doing it now. Rather than over binarize, first make money by being frugal and then retire I’m starting to enjoy now and really appreciate the journey that is life. I’ll never retire but I might work on things that don’t make money because they are fun. A reader of this blog emailed me one day and that idea marinated for a while before I really started to take his advice to heart.

It’s my goal to never have another job interview but we’ll see

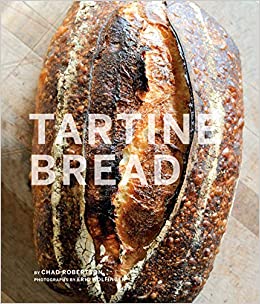

A book called Tartine Bread was oddly enough the catalyst for taking the plunge. I’ve been baking bread for a while, damn you COVID for the yeast shortage, and I always gave up after 2 months of steady work. It was just too much effort.

In his book, Chad Roberts goes over how he tries to make the bread work for him and not be held captive. Say he has errands to run and won’t be back exactly at 6 hours as a recipe demands, well he slows down the fermentation through temperature or yeast. Or changes what he makes. He doesn’t let the bread rule his life. He rules the bread. Check out his bakery

A few of my friends could tell you back when I got into sourdough in 2017 that I did bail or not hang out because I was trying to feed my starter at just the right time, or get my folds in perfect over a 3 hour period. And that’s not the way to live.

Bread is adaptable and so are many things. Many things we think are zero or even negative sum games can be so much more. I love the hobbies I have like gardening and cooking in that the possibilities are truly limitless. Faviken existed somehow, a remote Michelin starred restaurant that channeled its rugged location into inspiration. People everywhere can cook amazing food and it seems to me that their limitations empower them rather than the other way around. Why do you think Rene Redzepi loves fermentation, hint: it’s cold and citrus is rough where he lives. Also preserving things is important in his climate where things can be highly seasonal. At least that’s what I think (Edit: sure enough, page 158 of his fermentation book alludes to exactly this). And why does apple pie exist? Maybe because apple tree growers end up with so many apples they need to do something with them.

Necessity is the mother of invention after all.

Tired of Schilling

In the past whenever I had a book link I would always link to Amazon. They have a great affiliate program in which I get ~6% of whatever you buy on Amazon if my link was the last affiliate link you clicked to get there. But I’m tired of Amazon.

Amazon is great and all but they are slowly eroding their quality by allowing gamification and I don’t think they are a great platform for creators. So I’m done with that for now. At least on Ergosum. Not worth the coercion and I think it’s degraded my content planning. Goals shape policies and policies shape goals. It’s best to be free-er in your principles.

Skills that Matter

Long ago I was fascinated by non-linear changes. Partly because as a nerdier person it doesn’t do me much good improving something from 90->95% accuracy. Your improvements will always be bounded at 100%.

As a nerdier person there are many ways to become more skilled at bookish things.

A colleague at a client of mine recommended I check out Pirsig’s famous book, Zen and the Art of Motorcycle Maintenance. This was also Phil Jackson’s required reading for the many time champion Bulls and Lakers players. Sure enough, Pirsig’s gumption traps encapsulates exactly what I’m talking about here. A great way to apply nerdiness for personal gain is to become aware of peoples gumption traps for blind spots.

Say you lived your life knowing energy is expensive. Or the news overyhypes pandemic risk. Well what happens if that’s wrong? What if energy becomes cheap, you need to go through your whole brain and re-question your assumptions. If energy is cheap then we can do silly things like pump water across the US to alleviate extreme weather (floods and droughts). How could this change the future?

I realize this isn’t the best example but you must think through everything. And us humans aren’t adept at reconfiguration. That’s why many bettors wait until they have all the facts before trying to make a decision, we are far too slow to change our minds. Wait until Sunday morning to make your NFL bets. Or Saturday night when most injuries are known and you can map out the scenarios based on the inactives report released 1 hour before games.

Oddly enough, the opposite of the hypothesis driven scientific method is exactly this method and it’s used by detectives. Don’t form judgment before having the facts. Funny now that government says, we trust science yet trusts their detectives too. They use opposite methods yet are in the same field of discovery. [If you like random hypocritical truths like this then you should read Noam Chomsky. He is a gem]

The ability to reconfigure is something I admire about George Soros, or at least his writings, and something I try to be cogniscent of myself. The puts I bought were arguably on the worst possible short, the top 100 mostly tech stocks and the position began to change on me. I believe in the long term stock market. Rather than double down or simply close my position and switch to cash as a debated how low things could go, I reversed my position entirely, sold the puts and placed all the cash into a general stock market index. Many, many people feel this is too rash when placed in the driver’s seat. They double down, or sell first, then wait then re-evaluate. I view it more as a switch. The problem becomes when I over-binarize outcomes more often then most. A problem I realized when betting on Draft Kings. Sometimes the only conclusion that can be drawn is chance. Will Hollywood Brown on the Raven’s replicate his dominating 1st game as a rookie or not, maybe he will just have a solid game and get 13 fantasy points. Not 3 or 40 as I too often think.

Some environments are prone to ripples whereas I do better with crashing tsunamis.

Computers and formulas are far better in the ripple environment. They can appropriately weight the difference between 55% and 60% likelihood. But a human cannot.

Inflation

Modern monetary theory is another example of an area where a massive recalibration of beliefs must be done. The government doesn’t spend money, it issues it. Balancing the books is foolish. Whether this is temporary folly or long term the answer is under debate but you can’t argue MMT’s (Modern Monetary Theory) predictions are more realistic than the much talked about interest rate unemployment rate relationships and money supply based inflation theories. Academia and economics professor are in the tallest ivory towers I have ever seen.

Read Stephanie Kelton

Why Vegas

As I said I like gumption traps. Many people when they hear Vegas fixate on the Strip. It’s why most come to Vegas anyways.

But once you look beyond the Strip Vegas is an awesome place to live. Mountains on every side, great mountain biking trails, great food and entertainment options, low property tax, tons of sunshine (great for plants), cool roadtrip options (just 5 hours to the beach), and no state income taxes. I can totally take the tax money I save from moving here and use it to stay in IL for a month during the summer and still come out ahead.

This phenomena is actually a cognitive bias related to storytelling and plausability. We find more specific things realistic than their more general counterparts as they resonate better if we can relate them to a personal experience. I apologize I don’t have the best analogy at the ready but trust me, it’s in Thinking, Fast and Slow or Thinking and Deciding. Try out more specific lies next time you play Fibbage on jackbox or are trying to convince someone. An anecdote can be much more convincing than statistics. The anecdote being the Strip. Perhaps I can convince you with some social proofing! Saw this today

Subtract out the Strip, most cities don’t have one anyways, and boom evaluate Vegas that way. The fixation people have causes Vegas to be less than the sum of its parts.

Anyways, check out this pic of the trails near my house

Also look at this computer stylized version. Still working on this sort of thing, I also recommend you look at ArtBreeder until I say more about this.

I was also annoyed about parties being rained out or too cold in IL.

Seriously, ignore the strip and think about Vegas. Lots of sunshine, cheapish homes although rising, and minimal traffic. 20 minutes is a long drive for most locals. Many entertainers come here and so far friends visiting has been making the distance easier.

A note to home shoppers, look at monthly payments given your mortgage when you go to buy a house. Taxes are a huge component and in IL I could have only bought a house 20% less than the one we did buy.

A big objection is what about the job market? Well I’m blessed to be interested in computers and good at them. Remote work is going to continue increasing and the pay cut I took at first to freelance has given me the freedom to live wherever. I hope I’m never forced back into a regular job, or a job interview for that matter, but every year more and more companies hire remote so it should be fine.

Echo, echo, echo,… chambers

The danger of “trusting science” and the way companies work today is they constantly optimize for today. Policymakers, at companies and in governments, don’t realize or, more likely, don’t care, about the problem with over optimization. Twitter, Google, and Facebook show you what they think you want to see which in turn builds echo chambers. Amazon priortizing revenue through easily defeatable marketplace manipulation (changing products after building up good reviews, less defeatable methods: creating new listings, paid reviews, etc).

Oftentimes there is no one truth. There are schools of thought and it’s good to see them all. Many of the popular science articles that talk about quantum mechanics are guilty of this. How often do you hear about the Copenhagen interpretation? That’s what most popular science outlets spew and present as fact when talking about the quantum world. What about Bohmian mechanics and how Bohm’s PhD adviser Oppenheimer fueled by McCarthyism helped keep him out of mainstream science. Understanding the history of ideas and how the present discourse is where it is helps you know where to dig deeper.

The Importance of Renaissance Ideals and Generalization

As people continue specializing the value of generalizing increases and I find it a good way to discover universal truths. Negative space is a common form of art, and strategic pausing is great in rhetoric. The way Frusciante of the Red Hot Chili Peppers discusses creating melodies by leaving out certain notes so you can imagine them is also a common way to convince people. Never present all the facts to justify your conclusion. Present facts in such a way that the audience can come up with the conclusion themselves. It’s much more convincing when they “come up” with it themselves. And it also makes for good music. A similar concept is used in U2’s Ordinary Love (deconstructing chords also helps make it easier to move your fingers around, watch the second chord transition into the third especially.)

Alfred North Whitehead‘s Adventure of Ideas is a great book about this too. In different historical periods certain concepts were more important so more ideation was done on the merits. Like the universe is a field of truths and different settings or time periods bring these examples to the forefront. A big one was slavery and freedoms. Now we don’t have blatant slavery but there is definitely some slavery through coercion and people have a tough time opting out of the society we have today. See wage slave and think about healthcare. Farther back in history we had time periods where physics was totally different too. See the Electroweak epoch. Electricity and magnetism being fused is how electric motors work too. Lets hope those 2 forces don’t separate any time soon.

And how often do you think about government in a constructive way? As in constructing rules like the US founding fathers did. Personal property protection by governments is essential to having a monopoly on force to stay in power. We don’t think about this much but during the period of serfdom and noble families warring it was much more important. Richard Epstein is an interesting scholar here

Also reading Whitehead is helping me appreciate strength in process rather than view the world as a scene with actors, the process creates the reality continuously. (Has very interesting application to Einstein’s thought experiment of riding alongside a beam of light). The way Buffet likes to buy good companies at a reasonable price is a good way to invest. Rather than anything at the right price. If you have strong management and brand the good news will come. That is the process!

Kicking myself for not staying in Netflix or Amazon when I did. I bought netflix because my microeconomics teacher taught me about price elasticity and people had the wrong idea back when Netflix was trading ~80 in 2016. Similar things have happened throughout that company’s history. And with Amazon I bought just before they were releasing metrics on their AWS cloud platform. I thought finance people didn’t fully appreciate how big the cloud would be. Shortly after earnings revealed I was right I sold. I figured my thesis had ended however I also viewed management as quite strong. Marc Randolph of Netflix has quite the pedigree (descendant of Sigmund Freud and related to “the father of public relations”/a pioneer in the field of propaganda…). And Netflix is supremely efficient at creating shows. Recognizing the good is tough. Bezo’s management philosophy has been quite efficient especially with his famous meeting style of dossiers and agendas. I found a great entry point and should have stayed in!

Now I’m bullish Upwork as it was a quite attractive investment when I had money to put in back in July and UPWK was trading at $14 and the S&P mostly rebounded. Management seems goodish and I’m hoping the CEO Hayden Brown’s past career at Microsoft mergers and acquisitions pays off and they get a LinkedIn style buyout. When multiple indicators like trading below IPO price, bullish news like Fiverr’s strong performance and remote work, management, relatively low multiples compared to peers, and personal experience working on Upwork for years it’s a good time to bet. Never trust a single model, use multiple and beware of each blind spot. We’ll see if I continue to be vindicated, now UPWK trades around 45 so it feels good.

Speaking of stocks and stuff, I recently got my Series 65 and can register to become a investment advisor. Self study on Kaplan worked great. I like financial planning, not just stocks, and much of the advice for freelancers/self employed peoples is not right.

Reflexivity and Cycles

The understanding of process is much like George Soros’s reflexivity. I applied this with moving to Vegas, we could have rented first, that is conventional wisdom. But the act of committing wholeheartedly changes your experience. It’s much more painful if it doesn’t work out so you try harder. You focus on long term rather than short. Faviken was freed to ideate after committing to its remote location. Recognize your prisons and use that recognition to free you to accept them totally or remove them. Krishnamurti is a great writer here. Total Freedom is the book I am reading of his.

In a way commitments are freeing, at least if you accept them. Same as getting married.

You get what you give, be the change you want to see. There is no way to just be an aloof observer. Same as quantum mechanics with the uncertainty principle I may add. Your actions shape your reality and your reality shapes your actions in a never ending cycle. Also watch Dark, excellent show related to cycles.

Speaking of cycles, the best way to understand chaos is to understand the range of estimates. Saying COVID deaths will likely be X is silly. You must appreciate that various scenarios can happen and understand the vastly different outcomes in each. A 0.1% probability of 20% death rate is quite terrible even if odds are that it won’t be too bad. That’s why early shutdowns are good until we can figure things out and appreciate what could be. Many standard risks become common/assumed and are discounted into acceptance leading to blowups. Like the economic blowups in 08-09 with rating agencies.

Back on politics, at times I support a “dystopian” world like the Brave New World because I truly believe a benevolent dictator is the best form of government. The issue is finding the benevolent dictator. Python was blessed with Guido van Rossum. Rome had the Caesar’s. Eventually Rome decayed. The transition of power is a perilous step. All organizations tend towards ruin. Likely caused by their overzealous attempts at preservation.

Plans for 2021

I’ve realized I need to stop hiding behind online personas and being scared of how my opinions will be received. The way I started this blog as an anonymous person was naive. To lead the life I want I need to allow myself to be publicly wrong.

Part of growing up is having opinions and disagreements. In the long-run I think this will help improve my relationships with people. I’m good at talking to people and trying to find out what makes them tick without judgement. My wife calls it “sucking people off with words”.

It’s nice to do that but at times honesty is the best policy lest I get into familiar situations where people assume I agree with them and find me to be two-faced.

I’m working on some new projects in the vein of promoting discussion and understanding perspectives. As well as AI products and learning materials. I’ll keep you updated as I launch things

Vegetarianism

I don’t find killing animals for food necessary so I am doing my best not to do it anymore. I started cutting out meat in November of 2019 and recently and working to cut out seafood although sushi is delicious. There is vegan sushi near me though.

People who know me know I used to cook a ton of meat. 3 steaks in a weekend in those Walmart prime NY strip family packs, smoked brisket and pork belly on the regular. This vegetarian journey all started with my wife being vegetarian. A seed was planted that this is an option and it’s doable.

Over time I worked to improve my cooking and got into butchering meat. Bones -> stock and viewing eating the whole animal as a challenge to make taste good. I would buy whole chickens and take them apart. After a while it was weird to look at all the chicken breasts at the grocery store. It was crazy to think about how many chickens that was. The same goes for those 20 packs of chicken wings.

I continued living but feeling slightly worse about meat. Then I watched a lot of cooking shows. After a while the chefs look like sociopaths. Like how some amazing Japanese restaurants remove spines of fish so when they are ultimately killed they don’t release as much stress through the body as stress makes things taste worse. Many chefs get an odd glimmer in their eye when they bust out the cleaver. Why is human flesh sacred but not these animals? If you’ve ever been around animals you can totally see they are full of life.

After a while I watched Game Changers with my wife and that was it. There’s no reason to kill for food if you don’t have to (it is subsidized in the US and sometimes cheaper/convenient for people).

I don’t try to judge other people, I find missionaries annoying myself. If people want to learn why I do it I tell them. Perhaps that plants the seed. Otherwise I just carry on. I love food but truly I’m thrilled with bread. It’s delicious and complex.

What do I Eat

Now that I’m vegetarian I find myself focusing much more on the other ingredients. Perfectly fermented bread, alcohol, the millions of plants out there. It’s a vast world. And if Faviken is any indication, you can make great food anywhere.

I try to avoid making vegetarian substitutes and viewing them as such. Lab grown I get . But why limit yourself to just what the meat eaters can do? Focus 100% on what you have and see what you come up with. This is generally a good strategy in “positive sum games”, where there is enough goodness to be found. And based on the restaurants I’ve seen exist I strongly believe food is positive sum. In games like football sometimes you need to hit your strengths hard and whip out some 3TE sets or go goal line formation and run the ball down someone’s throat. Enough with the gimmicks, football plays aren’t a quasi infinite universe, I’m looking at you Matt Nagy.

Back on my diet, I’ve been diving into various flours and plants. I love growing plants. A few seeds or roots from the green onions I buy go into my dirt and boom. A lot of food.

I’ve been trying out wasabi arugula. It’s really good and a perfect more peppery arugula that pairs well with creams and small bites of food.

Another source of inspiration is areas across the world. The Gansu province of China is very arid at at a similar latitude to me. I learned a lot about noodles and gluten dishes. Also lotus root chips are delicious.

Another surprising example is more of a philosophy towards plants. In my naive view, because of the failings of the USSR, Russia still has many households with dachas or food garden plots. Essentially people there grow a lot their own food so they likely have many heirloom varieties and interesting produce variability. I’m not too deep into Russian food yet but I did start growing some sorrel and will be trying out their sorrel soup. Very lemony flavor in just one leaf it’s crazy.

Surprisingly Vegas can grow many tropical plants too. The sunlight is great and it’s a lot easier to add water than remove it. I mean check out the palm trees if you visit. It’s like I live at the Nile of the West. Thank you Colorado river. Also if you didn’t know, Las Vegas means the meadows and there were many historical springs here. Most are dry but I live near the Spring Mountains and there are some active ones there.

Back on Vegetarian Stuff

The most common refrain when I say I’m vegetarian and explain why, is the food chain. That’s fine you do you, it’s not a necessary part however and I don’t do it.

I’m still OK cooking for other people meat and stuff. I try to focus on the bigger picture things and don’t go too crazy if something randomly has gelatin in it or the stock used for the veggie soup at a restaurant has meat as part of the base. At home I do but trying to be 100% perfect would cause me too much strife and I would likely give up.

The Ag-gag laws are a weird restriction to freedom of speech we allow. Pigs and cows are smarter than dogs too.

Closing

Whew, quite the stream of conscious. I’ll periodically write articles like this again and keep you updated on my projects. Likely continuing to write similar style articles as I have in the past.

I like how bannerbear gives you real metrics and is a cool way to do SaaS marketing. Might copy that approach.

Anyways thanks for reading feel free to follow me on Twitter or comment to get in touch

[…] job for me. I really bumped up my income and workload during the early days of COVID as mentioned in my last reflection. But again I’m at a point where maximizing income or swimming along in my same lane […]